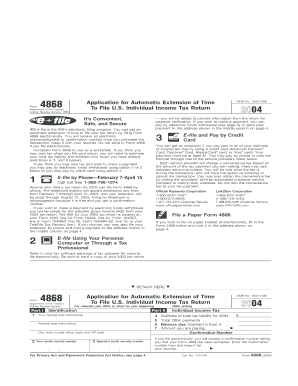

Line 4: Enter the estimate of tax liability for the current year. The names must be entered in the order that they will appear on the tax return. If you plan to file a joint return, information for both spouses must be entered. Line 3: If you file jointly, enter your spouse’s social security number here Line 2: Enter your social security number Part I (Identification), and Part II (Individual Income Tax). The 4868 must be filed on, or before the regular due date of the tax return, which is usually April 15th.įorm 4868 is a very short form. No, the 4868 Form is not accompanied by other forms. Is the Form 4868 accompanied by other forms? If the 15th falls on a recognized holiday or a weekend, the due date is the following business day. In order to avoid penalties and interest, any taxes due must be paid on, or before the April 15th due date. Note that an extension of time to file is for the income tax return only, not an extension of time to pay any taxes that are due. The purpose of the Form 4868 is to request an automatic 6-month extension to file the U.S.

Individuals who want to file an extension of time to file their individual income tax return need the 4868 form. Individual Income Tax Returnīecause at some point everybody needs a little extra time, IRS Form 4868 for requesting extensions on personal tax returns. Form 4868 - Application for Automatic Extension of Time to File U.S.

0 kommentar(er)

0 kommentar(er)